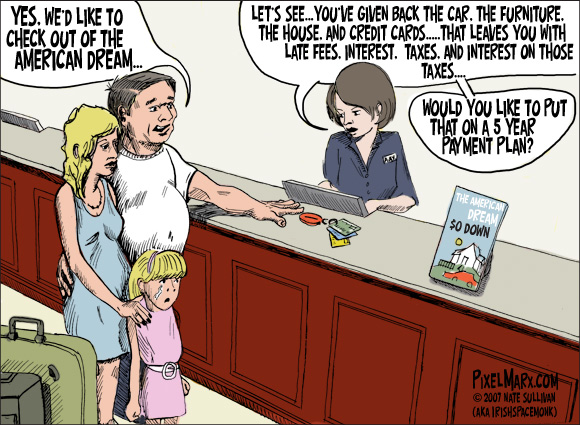

On a holiday eve, the Treasury announces that they will back Fannie & Freddie to unlimited losses. Yes, you read that right...they will not cap how far or how much they'll back bad mortgages, essentially to infinity. This has caused investors and speculation to scramble about what this means...

One potential answer? Free mortgages!! That's right, big loan forgiveness (similar to how student loans can be forgiven) appear to be a-coming. May wanna start buying some homes if you are the gambling type.

“Given this outlook, we believe that the main driver of this significant change is the flexibility it gives the government to take more aggressive action to support the housing market, including potentially going down the road of allowing some form of principal writedown,